Speaking about finances with others can be very daunting. Words such as money, wealth, financial independence surface many emotions in people, including many negative emotions and it is important to do your own research about it as well and to find out your existing attitudes to money and wealth.

As a start, here are our responses to some of the most common negative responses we have experienced from others when we talk about finances. What other responses have you received? Leave a comment below or email us and we will get back to you (hello@financesisters.com).

To recap the main points:

- Know where you stand in terms of your monthly costs and ability to save

- Create realistic goals

- Dig deeper into your own attitude towards statements like this

Actions for you to consider next:

- Play around with a Retirement Calculator

- Make a start by saving - even with only $25 a month

- Consider your approach to risk and what this means for your expected returns.

"You will never be financially independent"

This is a pretty big statement and we think the "You" can be easily replaced with "I". Your Finance Sisters also occasionally fall into this trap of believing that we will never be truly financially independent. We also continuously have to remind ourselves and our loved ones of our goals and how we plan to reach them.

What we recommend here is to make sure that you understand where you currently stand and create realistic goals based on what you think you can achieve. You need to know the details of your situation in order to understand what it will take for you to reach your goals.

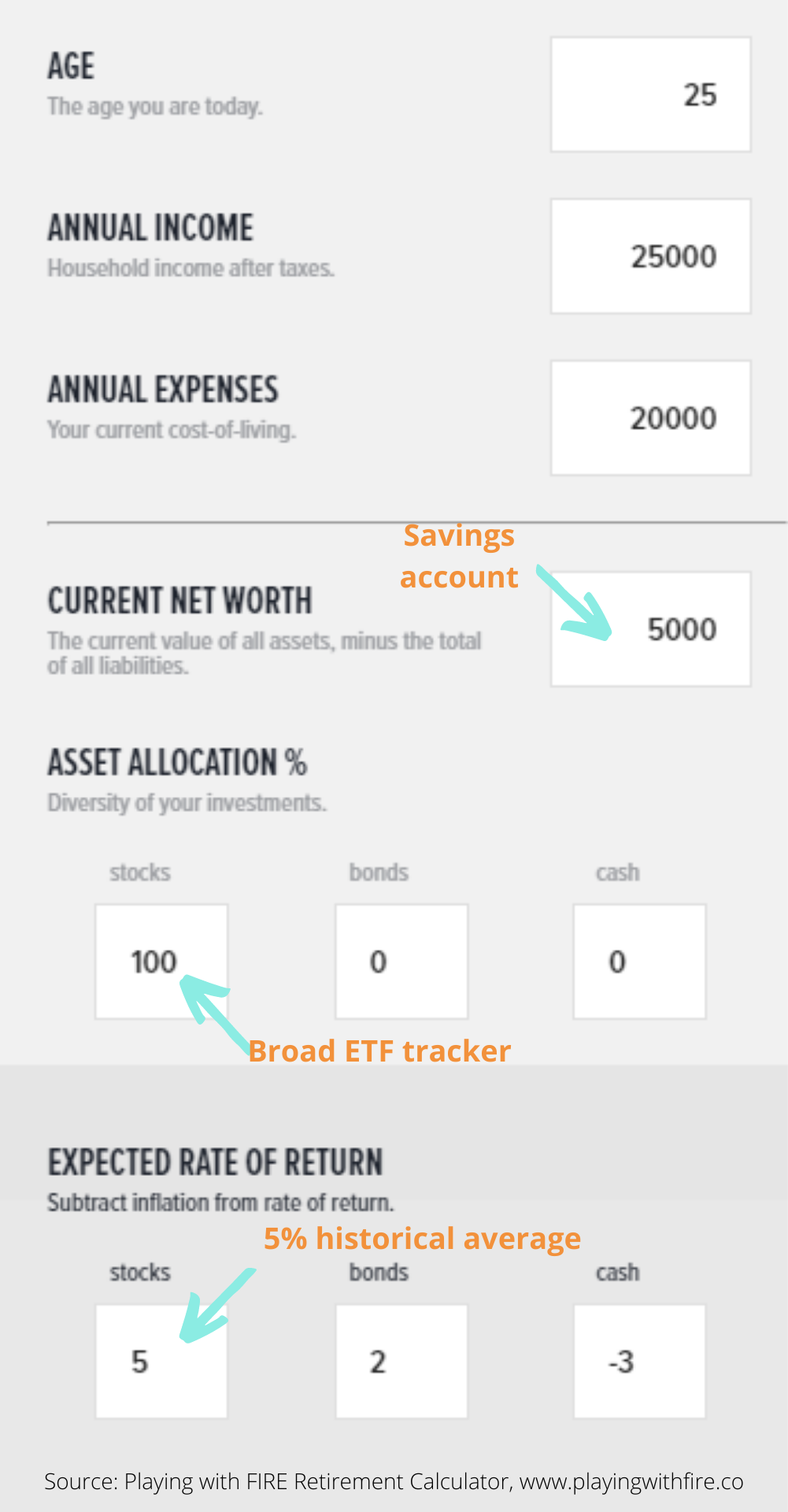

There are many excellent calculators online, and we are currently developing our own tables for calculating how much you need to save each month in order to have enough money to achieve your goals. If you are just starting out, then there may be some sections of these calculators that you do not understand. We explain them briefly in the below image, taken from the FIRE Retirement Calculator. What we like about this one is that it does not try to sell you anything. Beware of these practices when you search for calculators online.

Retirement planning scenario:

Madeline is 25 years old and earns $25k per year. She lives below her means and needs $20k a year to live and can save $5k. She also already has $5k from a savings account her parents started for her when she was young. She regularly invests her money in a broad market ETF, which means it is invested 100% in shares.

We have added Madeline's basic information into the retirement calculator.

- You can also use this calculator for testing future scenarios when you have higher income and also higher expenses.

- Saving $5k a year means saving just over $400 a month, or almost $100 a week.

- This section can be changed of course. We have put 100% into broad ETFs (stocks) that we have assumed will grow at an average annual rate of 5%. This rate of return is based on historical data and there is no guarantee that it will ring true in the future. In addition, this approach is considered a high risk approach.

- Note that cash has a negative rate of return due to inflation.

Over time you might assume a higher income, as well as higher living costs.

Don't forget that this is a scenario for illustrative purposes and based on a number of assumptions.

We clicked enter and get the following result from the retirement calculator: Madeline can retire at 60 years. At this point, she will get her income from dividends from the shares, as well as by selling some shares as well.

How do you feel about this result? We hope it makes you feel that you can achieve financial independence.

We like to remind ourselves of the principles that are important to become financially independent: Live below your means, invest early and often.

As we said in our pledge to you, we are not going to sugar coat what it takes to achieve your financial goals. This is not easy. BUT it is achievable. And really, what is the alternative? Even if you cannot save $5k now, we encourage you to make a start as soon as you can.

Financial terms alert.... we use some terms here that you may not be familiar with. Please look them up on places like investopedia.com if you don't understand them. As we are just starting out with the blog we cannot cover them here now but we will strive to do so in the future.