We frequently ask ourselves, "Is now the right time to invest?", "How will the COVID-19 pandemic influence the stock market in the next few years?" and "Does it make sense to invest now or shall we wait and see what happens?".

There are so many opinions out there and of course it is impossible to predict what the stock market might do. So in this post we go back to basics and look at how our investing principles can help to answer some questions on the current investment environment.

This post looks at the investment principle 1 from our book "Rule your Financial World - a comprehensive guide to becoming a Finance Sister".

Stay tuned for more posts that cover our other investment principles.

To recap the main points:

- "Invest and forget" reminds us to ignore daily, weekly, even monthly ups and downs in share prices.

- As we write this article, the stock market is trading at similar levels from before the Coronavirus crash.

- Long-term investors will experience many more crashes like this in the future. How you react to them will determine your success and happiness levels as an investor.

Actions for you to consider next:

- Know your attitude to risk and play with some risk assessments online. There are many, here is one from Vanguard.

- Read some timeless advice by JL Collins on staying the course during turbulent times.

- Review your long-term investment strategy once a year.

Investment Principle 1: Invest and forget

This is the first investment principle that we outline in our book:

"We propose a long-term strategy, that requires minimal maintenance. There is no need to check your investment more than a few times a year. Set up an automatic investment plan and don't get scared of day to day fluctuations in the market"

As a Finance Sister's way of doing business is based on a long-term strategy, the principle of "invest and forget" about your investments comes in handy during these times of quite extreme market volatility. This principle reminds us to ignore the daily, weekly, even monthly ups and downs in share prices that the stock market experiences, and continue with the investment strategy that we develop for ourselves. Yes, this strategy should be reviewed once a year and appropriate adjustments made. For example, if you are getting closer to retirement, then you might want to consider changing the allocation of assets in your portfolio.

For most people reading this blog and starting out on their investment journey, the market fluctuations brought about by the COVID-19 pandemic are relatively inconsequential in the long term. Although it is impossible to predict how the stock market will perform in the future, based on historical performance, there is a high probability that the market will continue to rise in the future and result in a positive return on your money. This is especially true in the longer term, of at least 10 years.

Word of warning: We do not recommend that you invest all your savings all at once as a lump sum into the stock market right now. Instead, we make small, regular investments (e.g. quarterly or monthly).

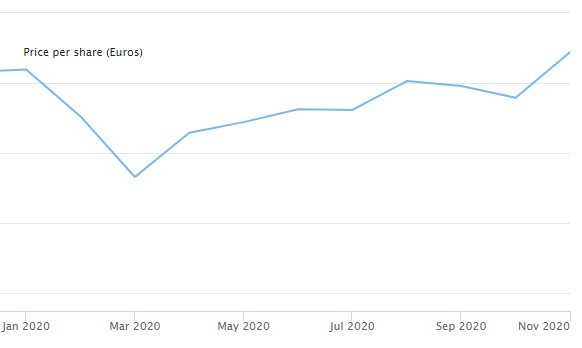

A nice way to illustrate this point is to compare what you would see if you looked at the stock market at different points during this year.

If you looked at the stock market only once a month, when you made your investments, this is what you would have seen (year to date in 2020). We've deliberately excluded the monthly share price and % drops and gains to focus on the bigger picture:

Monthly share price of Vanguard FTSE All-World UCITS ETF between January and November 2020

Image source: VWD Vereinigte Wirschaftsdienste GmbH

How does this chart make you feel? It is important to think about how you react emotionally to drops in the value of shares as it will impact your response to these drops. Emotions and the stock market are a very big topic in themselves that we will not tackle in this post, but it is important to be aware of how the changes in stock market prices make you feel. As part of your journey to ruling your financial world, we think it is important to understand your attitude towards risk, especially if you feel very anxious about these sorts of volatilities seen above. There are plenty of good resources online for this. Knowing your attitude to risk will allow you to make better investment decisions for your situation.

We're not trying to unsettle you here, we are merely trying to point out that the more you check the stock market, your accounts, finance news, etc., the more volatility you will see, which might make you feel uncomfortable.

Back to the chart... here a few more facts:

- March 16th 2020 represented the third largest daily drop in stock market prices in history. The market dropped so fast that the companies running the stock market had to temporarily stop trading to avoid full on panic selling.

- March 24th 2020, less than 10 days later, the stock market had one of it's top ten best performing days in history.

- Last week (13th November 2020), this particular EFT had recovered from the crash and is trading at higher prices than before the COVID-19 crash in March 2020.

Did you need to know these facts? We think Yes and No. Yes, because this is part of the volatility that you must accept and be comfortable with as an investor. No, because in the long term it does not matter as much as in the short term.

Some people consider the short term volatility as the reward for "staying the course", but we think that just investing and forgetting is an easier way to go about this.

Financial terms alert.... we use some terms here that you may not be familiar with. Please look them up on places like Investopedia if you don't understand them. As we are just starting out with the blog we cannot cover them here now but we will strive to do so in the future.