When buying broad-based traditional index funds or ETFs, you will most likely expose yourself to currency risk. Here we explain a few concepts to get you thinking about it.

Currency risk exists when you invest in assets that are held in different currencies, as the exchange rate between currencies changes over time.

Currencies can change slowly over long periods of time, or very abruptly with major events, such as the day the results of the Brexit vote were made public in June 2016 and the British Pound lost 10% of its value compared to the US Dollar in one day.

Changes in the exchange rates between currencies can also work in your favour over time.

There are a few variables that affect your level of currency risk, which you should be aware of:

To recap the main points:

- Where you live, your age and your risk appetite all play an important part in your approach towards currency risk

- The main currency risk lies in the underlying currency of the assets held by the fund

- You can hedge against currency risk, though this comes with a potentially high price tag

Actions for you to consider next:

- Think about the currency in which you will start living off your investments.

- Understand your attitude towards currency risk

- Get familiar with reading the fact sheets of ETFs so that you understand what currency risk you are exposed to

Domicile

For a citizen of a large economy or large currency zone it is quite easy to avoid currency risk. You buy ETFs that ONLY invest in companies domiciled and operating in your home country e.g. USA, Japan or your home currency zone, e.g. Europe. This way you avoid most currency risk.

Note: there is still some inherent currency risk in that some of the companies domiciled in your home country or home currency zone will be companies that trade internationally. For example Nestle operates worldwide and as such the business is affected by currency fluctuations. But it is up to those companies to manage that currency risk, not the ETF or investment vehicle that you might be invested in.

If you live in a smaller economy with its own currency e.g. Switzerland and South Africa, then currency risk is a fact of life as investing only in that country will generally not provide sufficient investment opportunities or diversification (which increases your risk of putting too many eggs in one basket).

How much currency risk you are exposed to

The Finance Sisters follow the simple yet effective approach that many other investors follow, by investing in traditional, broad-based index funds. We will look at the classic Vanguard All World ETF in this example.

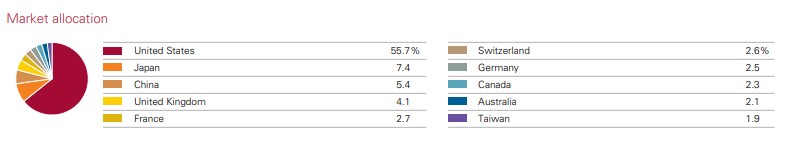

Here you can see that this index fund is 55.7% allocated to the US market and therefore 55.7% of the assets in this fund are priced in US dollars. It also has exposure to the Japanese yen as 7.4% of assets in this fund are prices in the yen. This means that by investing in this fund you will be exposed to long-term changes in all of these currencies. In this case it does not matter whether the currency of the fund is in US dollars, or in British pounds, the risk lies in the underlying currencies of the assets that are held in the fund. You can check your currency risk for the funds you are interested in in their fact-sheets, which are available on ETF search sites and also on the platform where you buy them.

Other currency considerations

The currency of the fund

Every fund has a currency in which they report in, which is most likely the currency of most of the assets that it manages. In our example above, because over 50% of the assets are in US dollars, this fund is most likely going to be a US dollar fund. In fact, most broad based traditional ETFs have the US dollar as their fund currency. In practical terms this means that the fund reports in US dollars, and distributes dividends in US dollars as well. Again, you can find the fund currency on the fund fact-sheets.

The currency in which you buy the fund

It is easy to get confused about the currency in which to buy the fund! The abovementioned Vanguard ETF, while the fund currency is in US dollars, for Europeans it is also possible to buy it in Euros, Pounds and Swiss Francs! So which one do we buy and why? Well, this might sound confusing, but the "trading currency" is the one you should buy that will best match the currency where you will most likely start living off your investments. So it is good to think about which currency you will be enjoying your investments in, and prioritizing this currency to reduce currency risk and currency exchange fees.

Some final thoughts

Hedging

If you are investing in assets where the underlying currency is not "your currency", it is possible to hedge against currency risk, by buying funds where the fund manager takes on the currency risk. This has not proven to be the most effective strategy for long-term investors (15 years minimum but more likely 40 plus years), and the fees for this are quite high, which in turn will reduce your returns over time. Plus, the currency might also work in your favour.... nobody knows!

Age, time horizon and risk appetite

Your age, time horizon and risk appetite will all be factors in deciding whether to buy a hedged or unhedged investment.

For someone close to retirement taking on currency risk may be considered too risky and in that situation an investment vehicle that is hedged against currency movements may be preferred.

For a younger investor with a much longer timeframe, then the cost of hedging may seem too high a price to pay to remove that risk, especially if the investment portfolio is exposed to a number of currencies.

By investing in long-term ETFs, you are already diversifying quite well. Another strategy is to weight your portfolio towards funds where the underlying currency is the currency that you think you will use when you start living off your investments. For example, a German-based investor may prefer to focus on a local stock market index, such as the DAX, which consists of the 30 major German companies that are listed on the Frankfurt Stock Exchange.

More information:

Read this article on JustETF about currency risk.

Financial terms alert.... we use some terms here that you may not be familiar with. Please look them up on places like Investopedia if you don't understand them. As we are just starting out with the blog we cannot cover them here now but we will strive to do so in the future.